JAck (age 62) & Mary (age 60)

Asset-Care Case Study

About Jack & Mary

Married Couple

Both Non-Smokers in Good Health

Jack & Mary’s Strategy

$8,500/month benefit are paid to each for:

Home Health Care

Assisted Living

Skilled Care

100% Full Refund of Premium

Jack & Mary’s Assets

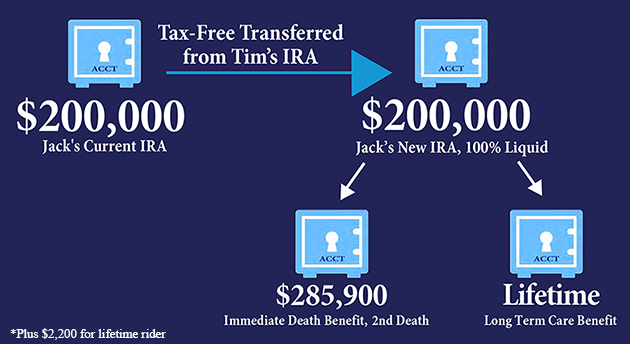

Jack transferred $200,000 of his retirement Tax-Free to fund the IRA for both him and Mary.

By choosing to pay with a single premium, Jack and Mary were guaranteed that no more payments would ever be required. Also, there’s no unexpected premium increases sometimes seen with traditional long-term care insurance.

Why This Worked

This option can help you keep your commitment to your financial strategy. It uses the security and guarantees provided by whole life insurance to help protect your retirement income stream if the need for care arises. This solution utilizes a fixed interest annuity to fund a 20-payment whole life policy with an accelerated death benefit for qualifying long-term care expenses.

By selecting a single-premium funding option, you don’t have to worry about paying ongoing premiums to keep your policy funded, since the premiums to fund the life policy are automatically deducted from the annuity. Also, there’s no unexpected premium increases sometimes seen with traditional long-term care insurance.

To learn more

Download an eBook on a product we have available:

All numeric examples and any individuals shown are hypothetical and were used for explanatory purposes only. Actual results may vary. These examples are not intended to represent the typical cost or performance of life insurance.

Any benefit amount paid reduces the policy's death benefit and cash value.